A Russian national being held in Estonia separate criminal charges will be extradited to Spain to testify to the investigating court to discuss his involvement in the fraud.

In a sign that the investigation and prosecution of individuals involved in the Juicy Fields scam is well underway, the Spanish court has now issued another extradition order. This appears to be the third one after the extradition and arrest of several members of the scam from other jurisdictions to Spain this year. The latest such extradition just occurred last month when Sergei Berezin, the alleged mastermind of the fraud, was extradited from the Dominican Republic to Spain.

On September 18, 2024, the Central Court of Instruction No. 6 of the Audiencia Nacional, the authority in charge of the investigation of the Juicy Fields case domestically, requested that a person of interest in the Juicy Fields case be temporarily extradited from Estonia, where he is being held for another criminal proceeding, to Spain.

So far, this unnamed individual, who has Russian citizenship, and is also being investigated in both Germany and France, has not been extradited per the objections of his lawyers who wanted him to testify via videoconference. However, Estonian authorities have agreed to allow his temporary transfer to testify in person before the Magistrate-Judge in charge of the investigation in Spain in order to ensure a clear and error-free statement with a translator to overcome the language barrier.

The individual in question is under investigation in the Juicy Fields case for receiving more than 36 million euros from the scam. Traceability reports prepared by the Judicial Police in Spain indicate that this individuals testimony could be crucial in aiding authorities in recovering funds and identifying other perpetrators.

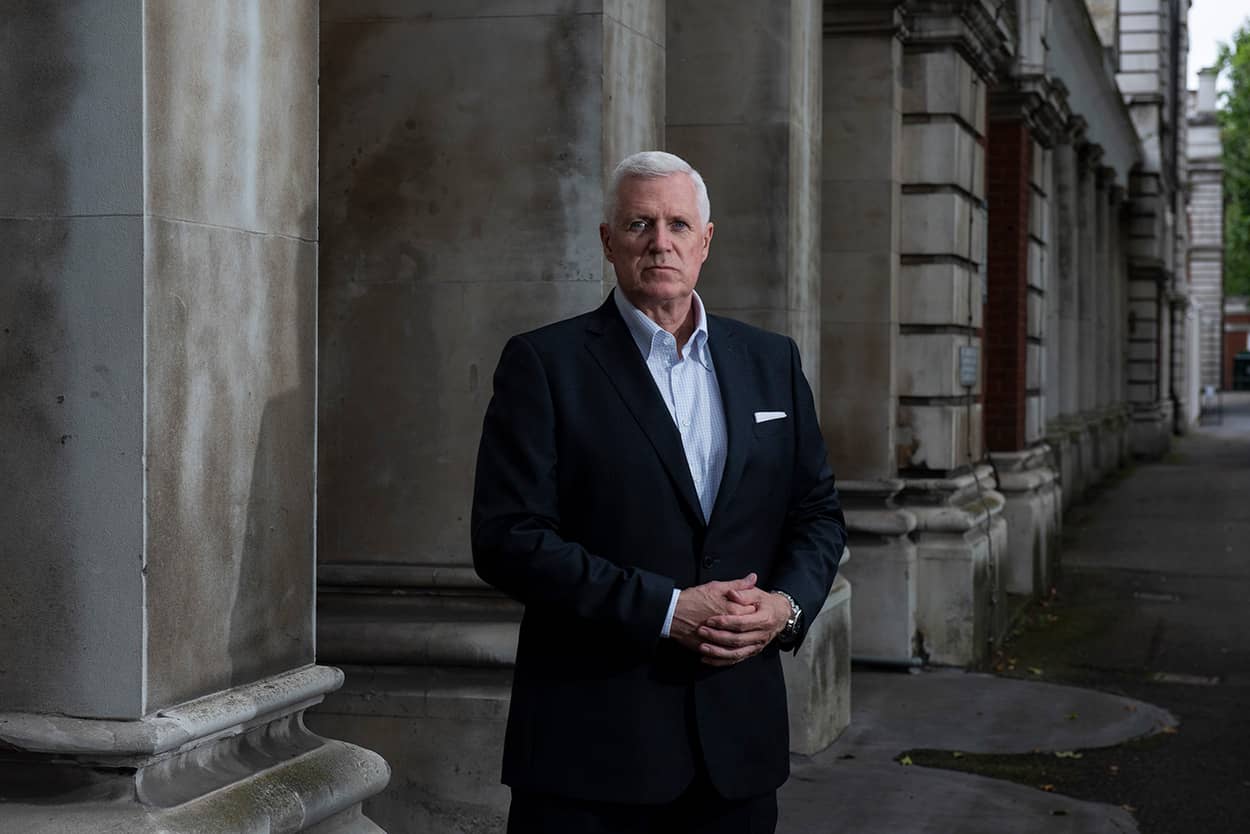

According to Lars Olofsson, this is a significant development. “What we are seeing is that Spanish authorities are essentially leading a European-wide investigation into the case, and they are clearly trying to make sure that no stone is left unturned,” he said. “Hopefully this will not be the last such extradition.”

What Was Juicy Fields?

The Juicy Fields scam was a large-scale cannabis investment fraud that promised high returns through crowdfunding for legal cannabis cultivation. Investors were told they were funding marijuana growth and would earn profits from the sale of crops. However, in mid-2022, the platform suddenly shut down, leaving thousands of investors unable to withdraw their funds. Investigations revealed that Juicy Fields operated as a Ponzi scheme, where early investors were paid with the money from new investors, rather than actual profits from cannabis sales. The scam is believed to have cost victims millions of euros worldwide.

“What makes what we are doing different than anything else that is going on is that we are not only working with authorities but pushing forward with our own prosecutions,” said Olofsson. “Regardless, any development of this nature is a win for us, and our clients,” he said. “It is overdue that these kinds of frauds are prosecuted with international cooperation because that is the only way to shut them down.”

What is the Status of the Juicy Fields Investigation?

The international investigation into the Juicy Fields cannabis investment scam has made significant progress – which is rare in these kinds of international frauds.

As of April 2024, law enforcement agencies across Europe and beyond have arrested key figures involved in the Ponzi scheme, which defrauded investors of over €645 million. The joint operation, coordinated by Europol and Eurojust, involved raids in 11 countries and included 38 house searches, with arrests made in Germany, Spain, Sweden, and the Dominican Republic, among others.

The scam, which ran from 2020 to 2022, promised investors substantial returns by funding medicinal cannabis projects. However, it turned out to be a pyramid scheme, with no real cannabis operations.

The investigation is ongoing with continuing arrest warrants and efforts to trace hidden assets and accomplices.

While authorities have seized millions in assets, the total recovery so far is far less than the amount lost by over 186,000 investors. Further legal actions, including private prosecutions (prosecutions that are separate from the state) are being pursued against entities that may have facilitated the scam, including banks and auditors.